Chesterton Accounting Update

Exciting times ahead with Chesterton Accounting and we wanted to give you an update on the changes to our firm structure. ...

Read More October Newsletter

Welcome to our October monthly newsletter! There are exciting things happening for the Chesterton Accounting team this October, a new ...

Read More September Newsletter

Welcome to our September monthly newsletter! The ATO have recently come across an issue in their accounts. Taxpayers who have ...

Read More August Newsletter

Welcome to our August monthly newsletter! The Federal Budget for 2023 announced plenty of changes, however there is one area ...

Read More July Newsletter

Welcome to our July monthly newsletter! Happy new financial year! We cannot wait to complete your tax returns. We do ...

Read More June Newsletter

Welcome to our June monthly newsletter! The 2023 Federal Budget was announced last month, focussing on cost-of-living relief, and modernising ...

Read More The Federal Budget for the 2023/24 financial year

The Federal budget for the 2023/24 financial year has recently been handed down in Parliament. Below is the list ...

Read More May Newsletter

Welcome to our May monthly newsletter! This month is extremely important for small business owners and accountants. The federal budget ...

Read More April Newsletter

Welcome to our April monthly newsletter! Welcome to April, the start of tax planning season! Now is the time ...

Read More March Newsletter

Welcome to our March monthly newsletter! The ATO has recently warned taxpayers on paying too little tax through PAYG ...

Read More February Newsletter

Welcome to our February monthly newsletter! We hope that everyone has settled back in well after the holiday break. We ...

Read More January Newsletter

Welcome to our January monthly newsletter! Happy New Year! We hope you all had a great Christmas with your families. ...

Read More December Newsletter

Welcome to our December monthly newsletter! The Chesterton Accounting team are taking a two week break this year and ...

Read More Final Countdown For Your Director ID

The final countdown is on to apply for your Director ID by the 30 November 2022. Directors of a company, ...

Read More November Newsletter!

Welcome to our November monthly newsletter! The wet season has started and major floods have already affected parts of ...

Read More October Newsletter

Welcome to our October monthly newsletter! Just like that, the first quarter of the year is over. It’s now ...

Read More September Newsletter

Welcome to our September monthly newsletter! The ATO have recently released data showing that over 180,000 tax returns that ...

Read More August Newsletter

Welcome to our August monthly newsletter! The Fair Work Commission has increased the national minimum wage by 5.2% and ...

Read More July Newsletter

Welcome to our July monthly newsletter! Happy new financial year! We cannot wait to complete your tax returns. We ...

Read More Superannuation to increase on 1st July 2022

Superannuation to increase on 1st July 2022 Superannuation to increase 1st July 2022 On the 1st of July ...

Read More June Newsletter

Welcome to our June monthly newsletter! Labor has won the election, but what does this mean for you - the ...

Read More May Newsletter

Welcome to our May monthly newsletter! “The hardest thing to understand in the world is the income tax” – ...

Read More Your Website’s Homepage

When someone visits your website for the first time, they will often begin their browsing experience on your homepage. It ...

Read More The Federal Budget for the 2022/23 financial year

The Federal Budget for the 2022/23 financial year The Federal budget for the 2022/23 financial year has recently ...

Read More April Newsletter

Welcome to our April monthly newsletter! Taxpayers that have been affected by the recent floods in NSW and QLD states ...

Read More March Newsletter

Welcome to our March monthly newsletter! The ATO have released a publication on starting a self-managed super fund (SMSF). This ...

Read More February Newsletter

Welcome to our February monthly newsletter! The borders have been opened and now the virus is continuing to spread, and ...

Read More January Newsletter

Welcome to our January monthly newsletter! Happy New Year! We hope you all had a great Christmas with your families. ...

Read More December Newsletter

Welcome to our December monthly newsletter! The Chesterton Accounting team are taking a two week break this year and will ...

Read More November Newsletter

Welcome to our November monthly newsletter! The end of the calendar year is nearing and of course that means Christmas and ...

Read More October Newsletter

Welcome to our October monthly newsletter! If you are an employer or intend to be then you should know about the ...

Read More September Newsletter

Welcome to our September monthly newsletter! The Government has expanded the SME Recovery Loan Scheme to now include businesses that didn’t ...

Read More August Newsletter

Welcome to our August monthly newsletter! We would love to welcome Shalee to our team! Shalee is our new administration ...

Read More July Newsletter

Welcome to our July monthly newsletter! Happy New Financial Year! We are ready for another crazy tax season so please ...

Read More June Newsletter

Welcome to our June monthly newsletter! It is now June which means the financial year has almost ended! If you ...

Read More May Newsletter

Welcome to our May monthly newsletter! “A person doesn’t know how much he has to be thankful for until he ...

Read More April Newsletter

Welcome to our April monthly newsletter! The federal government will be continuing the country’s stimulus package by boosting the travel ...

Read More March Newsletter

Welcome to our March monthly newsletter! The ATO have recently begun auditing businesses that have claimed JobKeeper payments which has ...

Read More February Newsletter

Welcome to our February monthly newsletter! JobKeeper has been a hot topic for small business employers and sole traders over ...

Read More January Newsletter!

Welcome to our January monthly newsletter! Happy New Years and welcome to 2021, we hope you had a great Christmas and ...

Read More December Newsletter!

Welcome to our December monthly newsletter! This year has certainly flew by and I think it’s safe to say that ...

Read More November Newsletter

Welcome to our November monthly newsletter! The Federal Budget for the 2021 financial year has been recently passed by Parliament ...

Read More October Newsletter

Welcome to our October monthly newsletter! We announced in June that we were going to donate $10 for every individual ...

Read More September Newsletter

Welcome to our September monthly newsletter! The JobKeeper payment scheme has had some changes once again due to the increase ...

Read More August Newsletter!

Welcome to our August monthly newsletter! The Government has just recently announced a six month extension to the JobKeeper payment ...

Read More July Newsletter

Welcome to our July monthly newsletter! Happy Financial Year! We have been extremely busy assisting our small business clients through ...

Read More June Newsletter

Welcome to our June monthly newsletter! There are exciting things happening for the Chesterton Accounting team this June, a baby ...

Read More May Newsletter

Well, it’s safe to say that no business owner could have possibly predicted what 2020 had in store for them! ...

Read More JobKeeper Payments – Enrolling & Applying

The ATO have released more information relating to the recent JobKeeper payments as part of the Government stimulus package. ...

Read More Working From Home Deductions

The ATO has announced a new easier method for claiming home office expenses due to the increase of people working ...

Read More April Newsletter

Welcome to our April monthly newsletter! We are delighted to announce that a new employee has joined our team! The ...

Read More JobKeeper Payments

The Government has just announced it’s third stimulus package update in response to the coronavirus outbreak. A wage subsidy will ...

Read More Queensland COVID-19 Jobs Support Loans

The Australian Government has announced a number of benefits for small business entities during this difficult time but each State ...

Read More Employer Obligations during the Coronavirus Government Restrictions

This is a trying time for all businesses but especially so the employers and their employees. Many businesses have been ...

Read More Economic Response to the Coronavirus

The Federal Parliament voted last night in acceptance of the $84 billion economic stimulus package. The bills have been ...

Read More 6 month deferral on small business loan repayments as a result of the Coronavirus outbreak!

Banks are now allowing a 6 month deferral on small business loan repayments as a result of the Coronavirus outbreak. ...

Read More Increase in tax benefits in response to the Coronavirus outbreak

The Government has announced an increase in tax benefits in response to the Coronavirus. Parliament will have a final sitting ...

Read More March Newsletter

Chesterton Accounting is growing again and we are currently looking for an experienced accountant to join our small team in ...

Read More February Newsletter

Welcome to our February monthly newsletter! Bushfires have been spreading over Australia during the last few months with many individuals, ...

Read More January Newsletter

Welcome to our January Monthly Newsletter! Happy New Year! We hope you have had a great Christmas. We are looking ...

Read More December Newsletter

Welcome to our December Monthly Newsletter! We are now in December, the season of joy! We hope that all of ...

Read More November Monthly Newsletter

Welcome to our November Monthly Newsletter! The due date for lodgement of an income tax return for the financial ...

Read More October Monthly Newsletter

Welcome to our October Monthly Newsletter! Single Touch Payroll registration became mandatory on 1 July 2019, however if you were ...

Read More Are you ready to hire a new employee?

Are you ready to hire a new employee and are unsure on how to organise their first day? See the ...

Read More September Newsletter

Welcome to our September Monthly Newsletter! You should find yourself pretty well tax ready by now and ready to lodge ...

Read More August Monthly Newsletter

Welcome to our August Monthly Newsletter! The low and middle income tax offset has now become law and will be ...

Read More July Monthly Newsletter

Welcome to our Monthly Newsletter! We, the team at Chesterton Accounting would like to wish you a Happy New Financial ...

Read More Claim Employee Super this Financial Year⏳

As an employer, you claim superannuation payments when they are paid – not when they are accrued, even if you ...

Read More Get set for a 3.0% increase to base pay rates

The Fair Work Commission have made new changes to minimum wages with a 3.0% increase after the 2019 Annual Wage ...

Read More Contractor or Employee?

New funding has been allocated to the Fair Work Ombudsman to help reduce “sham contracting”. If you are currently engaging ...

Read More Single Touch Payroll

Are you ready for Single Touch Payroll? As of the 1st of July, every employer will be required to use ...

Read More Wage Theft is Now a Criminal Offence!

Wage theft is now a criminal offence! Employers who are deliberately under paying staff could find themselves in jail. Wage ...

Read More Top Budget Announcements for Small Business

The Federal Budget was handed down on Tuesday evening with a few small changes for Australian tax payers. The most ...

Read More Small Business Instant Asset Write-Off Increase

The small business instant asset write-off is set to be increased from $20,000 to $25,000 and will be extended to ...

Read More Podcast: First Year Frontiers

Are you in your first year of business and would like to hear others stories on their successes? Listen to ...

Read More Deductions for specific industries & occupations

If you are confused when trying to work out your tax claims then please view the below ATO link which ...

Read More EOFY ready

Is your business ready for EOFY (end of financial year) ? Xero accounting software has a number of video series, ...

Read More Superannuation Guarantee Amnesty

The Government has announced from the 24th of May 2018, a 1 year Superannuation Guarantee Amnesty. This is a rare ...

Read More Everlance Mileage Tracker Application

Do you want to claim more for business related car trips but hate the hassle of writing in a logbook ...

Read More The Notifiable Data Breaches Scheme

The Office of the Australian Information Commissioner (OAIC) has set out new privacy laws from the 22nd of February 2018 ...

Read More Xero Advisor Directory

Do you need a certified Xero advisor to help you with your bookkeeping or assist you with your Xero account ...

Read More Employee Vs Contractor

The most asked questions I hear are on the differences between being an employee versus being a contractor. The below ...

Read More Travel & Meal Allowance for Employees

If you are in charge of payroll in the office then the below ATO link can help you identify the ...

Read More Automated Superannuation

Automated superannuation is available in most accounting software packages. This software provides a simple and quick process when making super ...

Read More Single Touch Payroll

Have you heard of Single Touch Payroll (STP) ? It's a new government initiative which will streamline payroll reporting, very ...

Read More Xero Online Accounting Software

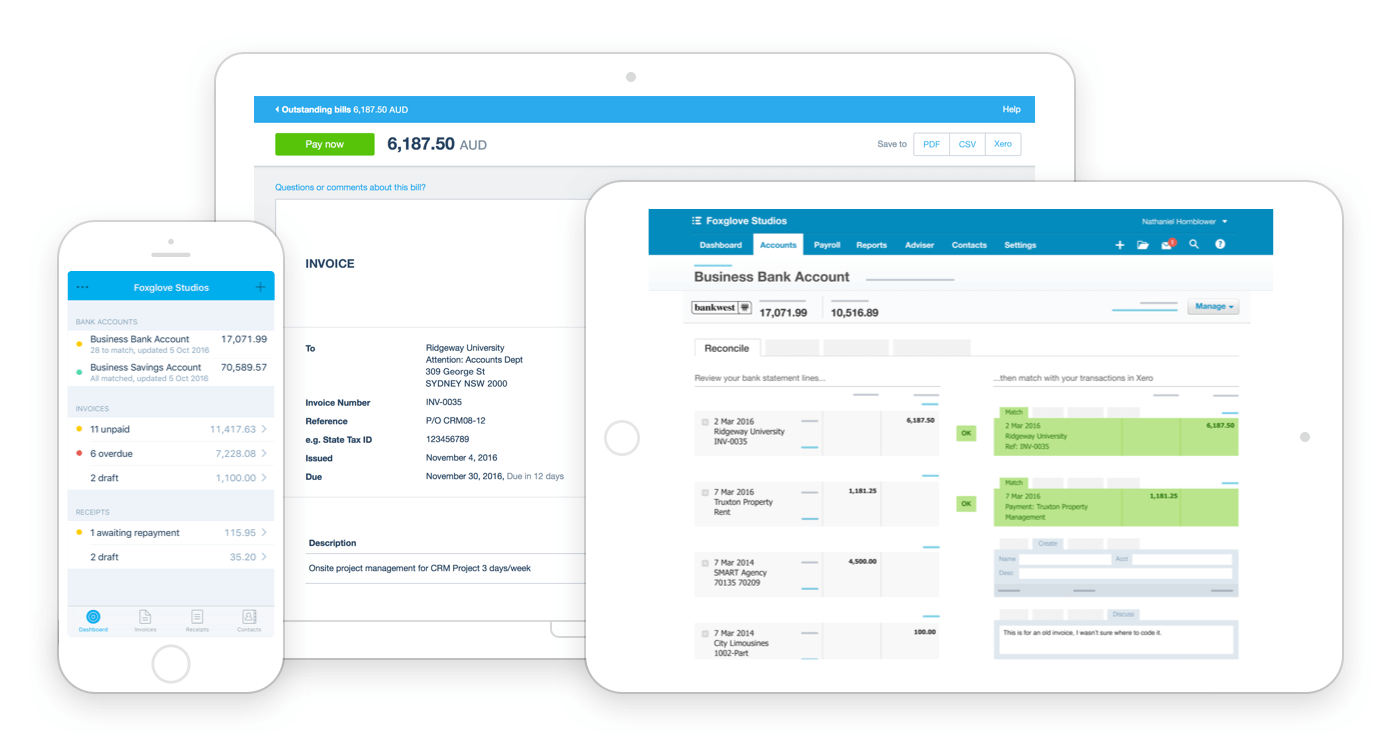

Xero online accounting software is cloud-based software that can be accessed anywhere. Features include entering daily transactions, processing payslips for employees, ...

Read More Simpler BAS

If you are a small business and you have Business Activity Statements lodged, then from 1 July 2017 your BAS ...

Read More Identity Crime

Protect yourself against identity crime ! Please watch the below video to learn more. https://www.youtube.com/watch?v=pQczpOx18lQ&feature=youtu.be "Think twice about what you ...

Read More 2017 Federal Budget Highlights

Please see the below link for an overview of the 2017 Federal Budget which was handed down last night. "Instant ...

Read More Record My Hours app

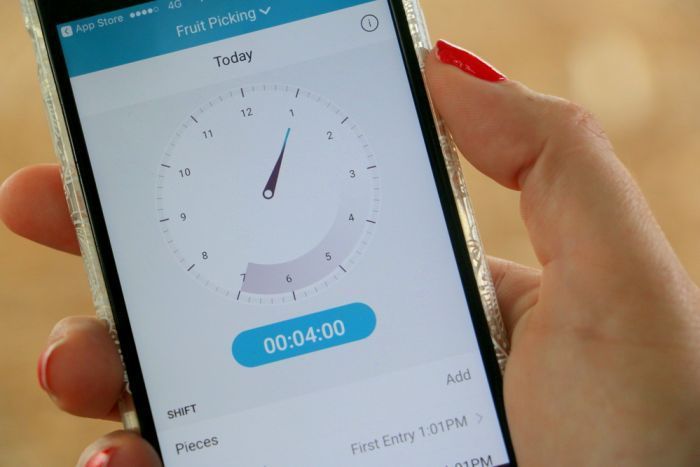

The Fair Work Ombudsman have just created an app for smartphones which records working hours for employees. "Using geofencing technology, the Record ...

Read More Accelerated depreciation for Small Business

Are you aware of the small business accelerated depreciation ? If you trade as a small business entity than you ...

Read More Small Business Benchmarks

Are you running a small business ? Would you like to see how you rank with others in the same ...

Read More